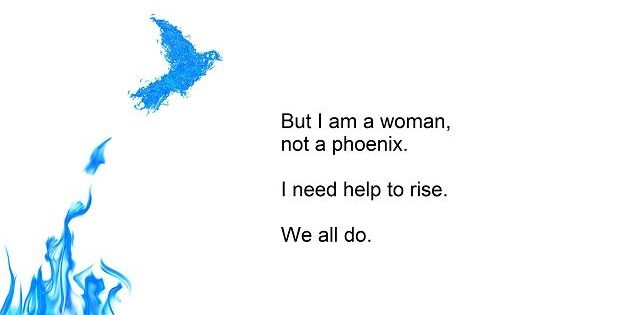

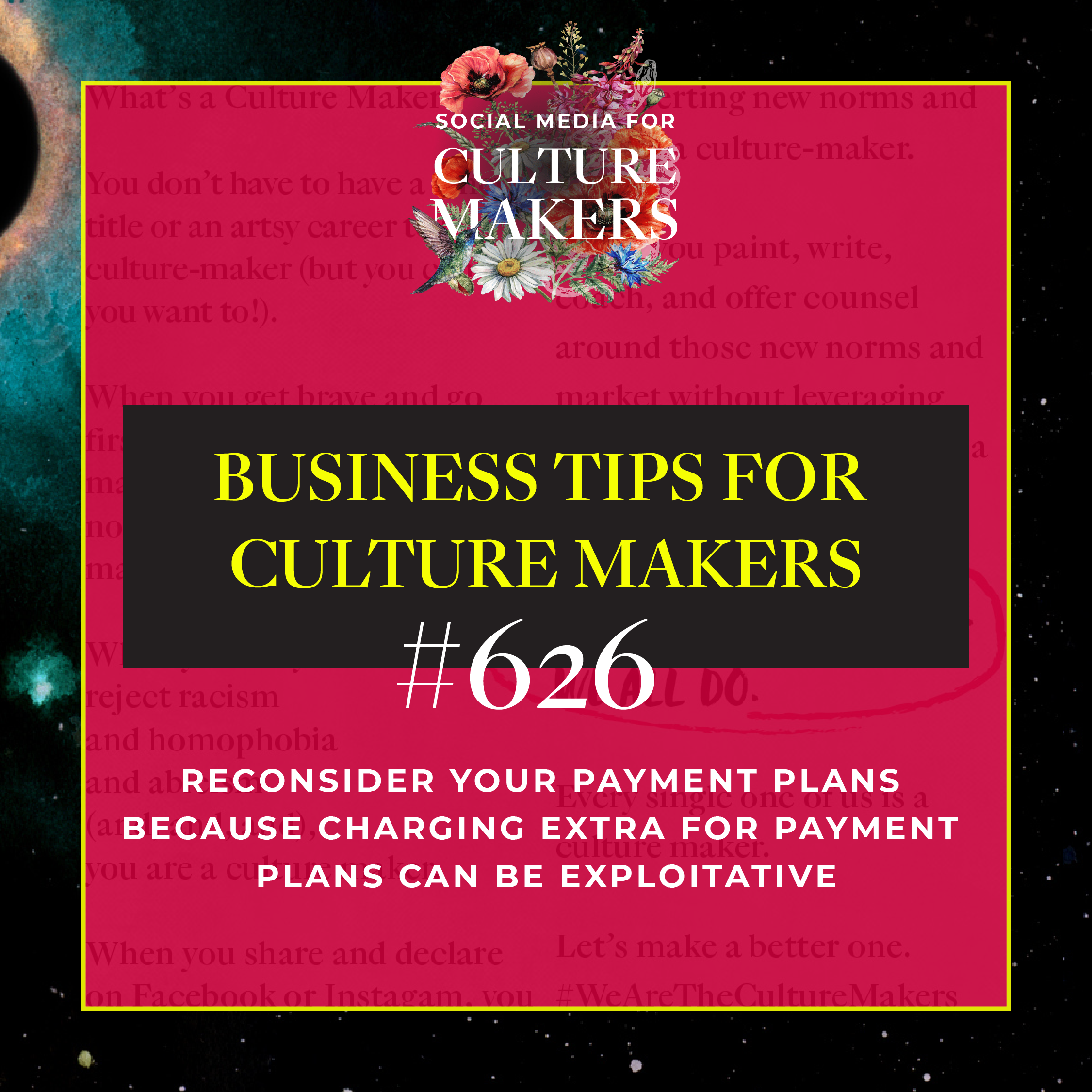

Business Tip for Culture Makers #626: Reconsider Your Payment Plans because Charging Extra for Payment Plans Can Be Exploitative

I’m looking around at our empowerment spaces at the payment plans being offered and I’m seeing some arguably predatory practices.

In keeping with our project — creating an equitable, inclusive culture and selling to our clients without selling them out — we might want to question the norm of charging extra for payment plans.

Although it’s the norm in our spaces, it’s a “business as usual” practice that can perpetuate financial injustice.

That Doesn’t Mean Finance Fees are ALWAYS Bad or Oppressive

We’ve got to apply nuance and analysis, here.

Sometimes finance fees are predatory. Sometimes they are not.

In some cases, the business is trying to create an additional profit centre with those charges, which means that the people least able to pay are paying more. And that’s textbook financial injustice.

And sometimes there are other justice issues are in play that we need to consider when making decisions about our business practices or who we buy from.

Here’s how to discern and assess:

- Undercapitalized, marginalized entrepreneurs may need to incentivize clients to pay in full because the entrepreneur does not have access to capital or investment and is boot-strapping growth out of cash flow — so full payments are urgently necessary. But if a company DOES have access to sufficient capital or cash reserves…charging extra for payment plans is arguably be an oppressive strategy, because it’s creating a profit centre on the backs of people with the fewest resources.

- Some businesses might have real, hard costs for running payment plans and these need to be recouped. If you have real, hard costs, then yes charge for those hard costs or build it into your overhead.

NOTE: I am raising awareness about the politics of finance fees for payment plans, and how to navigate them and make informed decisions about them as consumers and as entrepreneurs. I am NOT making a hard policy against mark-ups for payment plans. I’m saying we have to analyze carefully and make justice-informed , culture-making decisions about our practices

Here’s how Payment Plans Usually Work in Online Programs

Imagine there’s course or certification you want to take. It’s $6,000.

You don’t have that in cash, alas.

Good news! The vendor offers a payment plan, but with there’s a catch. If you make 3 payments over 3 months, the total cost is $7,500, not $6,000.

In effect, that’s $1,500 in interest being charged in less than 3 months. If my bank or a credit card offered that to me, I’d walk.

In reality, that seems more like a rate that a loan shark would offer you than a coach committed to women’s empowerment.

So why is this practice of charging 25% or 30% or MORE for payment plans so common in women’s empowerment spaces?

- Because it’s taught. I’ve joined MANY business/marketing trainings where the woman business coach explicitly taught us to do this. It’s the norm.

- Because it’s a strategy for incentivizing clients to pay in full.

ONE MORE TIME: There’s a nuance and a systemic issue here that’s important to note.

Entrepreneurs with marginalized identities are massively under-capitalized and have less access to credit we need to grow their businesses. That’s a systemic problem and a reality we’re navigating that shapes how we do business — and limits our growth. That means if we’re creating a big new program, we have to boot-strap the costs out of cash flow. That’s why so many women business coaches recommend the tactic of charging a huge extra cost for payment plans as incentive for full payment. They literally NEED the payment in full in order to fund the development costs of the program.

And…when those of us who are entrepreneurs do that, we’re offloading the costs of our systemic oppression onto women even less able to foot that bill. That’s not likely to be the outcome we’re trying to create. So let’s get creative about how to interrupt the cycle, rather than perpetuate it.

See Business Tips for Culture Makers #611 for a way to do it differently while still getting the up-front payments you need.

What That Means for You as a Consumer

So please, as the next season of launches swing into gear, consider this when you’re considering the price of a course and finance plans — either for the programs you offer or the ones you buy.

There are a few programs in our women’s empowerment space that levy an extravagant surcharge for payment plans.

They offer one price for lump-sum and a HUGELY different price – like 30%+ or more – for a payment plan. The difference can be thousands of dollars.

If the entrepreneur offers a payment program at a significantly higher rate than the lump-sum payment price – and at a rate that vastly exceeds what financial institutions are allowed to charge in annual interest rates – ask yourself if this choice of theirs is ok with you.

Does it show a lot of care and concern for their clients? What does it tell us about their business practices? What does it tell us about their commitment to justice and equity?

The program may be excellent. You may still want to take it. The founder may be brilliant and otherwise doing terrific work in the world. We don’t need to organize an online brigade and burn them down. You may, however, want to ask them privately why they’ve chosen to leverage an extra 30% charge on the people who are presumably the least able to afford it – and listen closely to the answer.

It’s one more data point to consider when deciding how to spend your money.

What This means for You as an Entrepreneur

For your own programs and business, let’s be clear, again: I am NOT making a blanket statement against finance fees for payment plans. I’m suggesting we navigate carefully and ask ourselves these questions:

- Are we undercapitalized and unable to afford the up-front costs of launching the thing without payments-in-full?

- Do we have hard costs associated with finance fees, defaults or collections?

YES, RECOUP HARD COSTS. There may be times when you do want to offer a discount for payment-in-full because there can be a higher risk of default in longer-term payment arrangements and costs associated with collections, etc. Some of the companies I’ve advised worked their numbers to find their actual risk and hard costs and charged THAT. (You can also build that figure into overhead.)

And…have you ever gone to a shop and they added $1.25 if you want to use a credit card or debit card to pay? I hate that. To me, that’s the cost of doing business and should be factored into all the product prices. Adding two cents to all the products would cover off that cost, for example.

We can apply that principle to payment plans, as well. If you’re going to offer payment plans, and you have hard costs, then instead of adding a surcharge to the payment plan, you can bake those costs into your overhead. That’s what I do in my own business; that’s why I don’t charge finance fees. I bake the hard costs into my overhead and spread it across all my prices.

(h/t Dawn Haney Consulting for the nudge to spell this out, here.)

To recap: in order for us NOT to exploit our clients, I’m urging us to make payment plans fair and reasonable and based on actual costs and risk, rather than a predatory “whatever I can get” amount.

And I’m urging us to push back when we receive marketing with levvies for payment plans that are 30% more (or higher!!) than full-price and ask question to the vendor about the logic underlying their decision.

- If they’re an undercapitalized founder, and need the up-front payments to fund the growth, that might be acceptable to you. (It is to me — but only if they are in fact undercapitalized. If their business is flourishing and has abundant cash reserves and access to capital, I’m not as sympathetic.)

- If they have actual hard-costs associated with running a payment plan at scale, I can be sympathetic, too — but I want to know that it’s based on hard costs.

- If that’s just their policy because they learned it was the norm; or it appears that it’s a profit centre in their business…I’m not paying. In these situations, it’s a predatory practice and source of financial oppression.

We’re growing the institutions of the future.

Let’s make sure our practices create the personal flourishing and the collective social justice we’re dreaming of.

Wondering what to do instead of charging extra for payment plans? I invite you to check out Business Tips for Culture Makers #611